Russia's attack against Ukraine dramatically changed not only political but also economic agenda in Europe. The Western countries responded by a series of sanctions, which mounted so fast that, by March 7, 2022, Russia became the "most sanctioned nation" in the world, easily surpassing Iran. The United States and Britain have been the major driving force behind the new strategy while Europe followed suit – in some cases without great enthusiasm (concerning sanctions against Russian oligarchs and super-rich individuals, it took the United Kingdom and the United States a whole month to put German Gref, a close aide to Russian President Vladimir Putin and the CEO of Russia's largest state-controlled bank, Sberbank, on the sanction lists, while both the EU and Switzerland are still refraining from following suit). One may criticize the Europeans for being too reluctant, but it is necessary to admit that the EU economy became the most affected both by immediate consequences of the Russian invasion and by the sanctions and countersanctions that it has caused.

(Source: Centralasia.media)

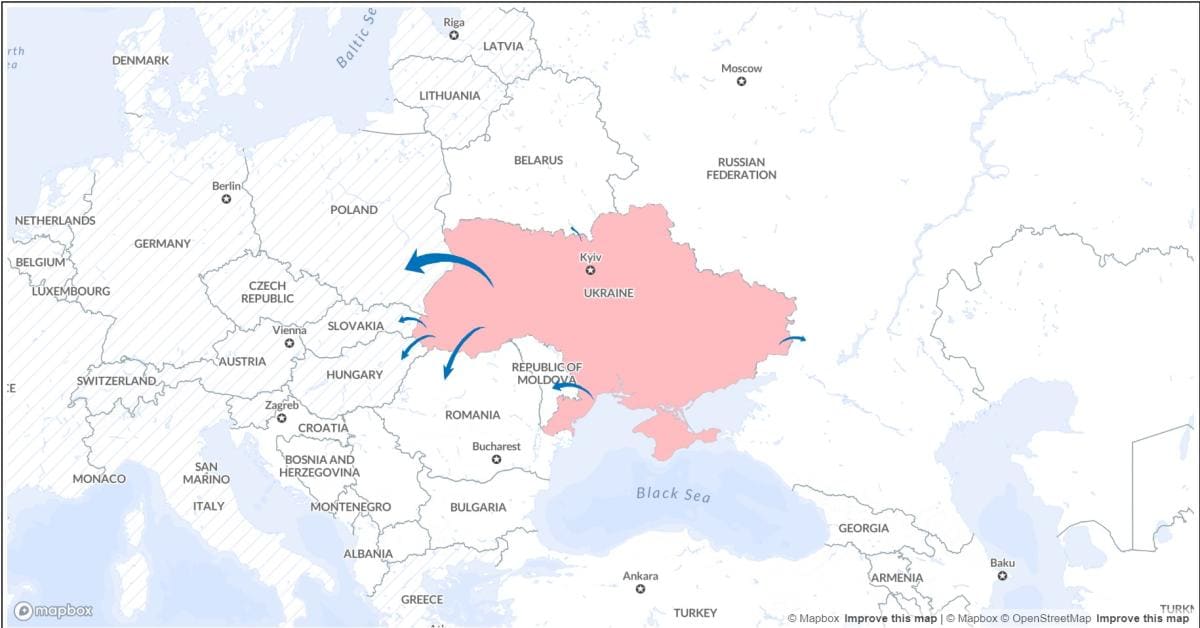

The Economic Impact Of Ukrainian Refugees Fleeing To EU Countries

The immediate effect of the conflict is the increase of spending caused by the growing Western aid to Ukraine. Europe allocates less than the United States (Washington declared a massive emergency package providing Ukraine with $10.6 billion in financial aid and at least $3 billion in military and technical assistance, while the EU disbursed less than $5.5 billion).[1] Yet, the EU took the major blow caused by a massive inflow of refugees (more than four million people fled Ukraine and more than half of them relocated to Poland.[2] Local governments in EU countries provide refugees with monthly financial assistance, housing, food, educational and medical services. In Poland, the law provides to new arrivals "a special one-off payment" of 300 zloty (around $70) per person and grants payments of 40 zloty (around $10) per day to people and provides accommodation to Ukrainian refugees.[3] Some estimate that the overall expenditure on Ukrainian refugees is around €1.1 billion (around $1.2 billion) per month, and as it is for now, it seems the relocated people may stay in EU countries (more precisely in Central Europe) for quite a long time. The European Commission recently proposed to increase by €3.4 billion (around $3.8 billion) the support to member states welcoming and accommodating refugees fleeing the war in Ukraine.[4] Yet, more funds will be needed soon. Of course, the newcomers can be integrated into the productive workforce and contribute to recipient countries' economic growth, but the effects cannot be estimated at this stage.

Refugees fleeing Ukraine to Central Europe (Source: Data2.unhcr.org)

Refugees fleeing Ukraine since February 24, 2022, are 4,059,105 (Last updated on March 30, 2022) (Source: Data2.unhcr.org)

Outflow Of European Businesses From Russia

The EU countries are also being heavily affected by the sanctions imposed on Russia. First of all, by cutting economic ties, European authorities produced a huge outflow of European businesses from Russia. Prior to the conflict, European investments (those originating from the EU member states, UK, Norwayö and Switzerland) accounted for 71 percent of Russia's accumulated FDIs.[5] Currently, most of the companies announced their withdrawal with few (predominantly French ones) still remaining operational.

In some cases, the economic losses are quite significant: for example, Volkswagen produced at its Kaluga and Nizhny Novgorod-based plants 171,000 cars in 2021,[6] which made 3.5 percent of its global output,[7] while Auchan, a French retailer, collected 9.7 percent of its gross sales from Russia.[8] Nevertheless, in the case of Deutsche Bank, the moral decision to quit Russia paid off. The German bank, which made less than $20 million as annual profit in the country,[9] increased its market valuation by $1.7 billion, as the investors at the Frankfurt stock exchange reacted on its announcement to close its operations in Russia.[10]

Yet, even if it is too early to assess the losses, I would say that in 2022 European companies will lose up to €12 billion (around $13.2 billion) of their revenue that previously came from Russia. If the business in the country will not resume, EU companies may face prospects of writing off around €20-25 billion (around $22-27 billion) in capital investment, since it may be very difficult to sell the industrial or retail installations to domestic investors.

European Investors Will Lose In The Financial Sector

Secondly, European investors will lose quite significant amounts of money in the financial sector. In fact, half of the total amount of European investments in Russian ruble-denominated bonds are held by foreigners, this means that no less than €5 (around $5.5 billion) should be written off, due to the delays in repayments to the non-residents, plus, the ruble will have a 25-percent ruble devaluation and furthermore a 12 percent "commission" will be imposed on those who want to exchange rubles for dollars (one can consider it to be a form of an "exit tax").[11]

Nevertheless, Russia avoided the full-scale default on its obligations as it repaid the coupons on its Eurobonds on March 17, and will supposedly serve the expiring Eurobond issue on April 4 on time (it should be mentioned that the Russian stock market contracted in dollar terms from around $800 billion in mid-December 2021 to less than $440 billion, as the trades resumed on March 24, 2022).[12] I would add that the European financial institutions have quite a huge exposure to it, so the losses might be estimated in between of $30 and $40 billion. It should be added that the fate of major European banking holdings in Russia (Raiffeisen Bank Russia and Rosbank, controlled by Société Générale) remain uncertain, and any attempt to get rid of them would incur additional losses.

Energy Crisis In Europe

The third and most debated issue is linked to the energy crisis in Europe. Yet, I would not agree that Russia has been the single cause of the European natural gas crisis of 2021, even though the war in Ukraine contributed significantly to its aggravation. Nowadays, the Western embargo on buying Russian oil and gas looks inevitable. Prices on heating oil and gasoline have risen by around 30 percent in the recent 12 months, while natural gas prices increased 470 percent.[13] Quite simple calculations suggest that the excessive burden levied on the European consumers and corporate sector may amount to €300 billion (around $332 billion) in 2022 (the estimates are usually made in the range between €190 and €340 billion – around $210 and $375 billion) that will require up to €100 billion (around $110 billion) in financial support from the European governments to households only.[14]

During the recent summit in Brussels, the United States and the EU announced a new partnership to reduce their reliance on Russian energy. In order to do so, Washington promised to increase natural gas deliveries to Europe, while all the G7 nations called OPEC countries to boost their production.[15] Yet, it seems that energy prices will remain high for at least a couple of years to rebalance the global supply.

Russia has reduced the amount of oil shipments to the EU (to only 47 percent of its total exports in 2021),[16] but it is still supplying Europe with high amounts of natural gas (around 77.5 percent of the total in 2019).[17] The situation would be quite different if Russia possessed a flexible transportation system, but the country exports more than half of its oil and 84 percent of its natural gas via pipelines,[18] therefore, at least in the short term, the Western embargo on Russia will result not in a sharp diversification in market outlets but rather in steep decrease of overall exports (I would say the oil exports from Russia may easily decline from 7.8 million barrels per day in December 2021 to less than four million this year),[19] and this will entail a price hike that Europe will pay.

Furthermore, Russian "countermeasures," as Putin's request that buyers of Russian gas should settle their invoices in rubles, will add more uncertainty in the energy supply as European companies already responded they will not accept Russia's new rules on gas payments. Europe may additionally spend around €300 billion annually, or around two percent of EU GDP, on energy in 2022-2024, with these expenditures becoming by far the largest negative outcome caused by Russian ongoing offensive in Ukraine.

Russian "Disinvestment" From Europe

SUPPORT OUR WORK

Forth, one should also look at the effects of Russian "disinvestment" from Europe. For example, contrary to the U.S., Russian presence in the real estate sector in places like London, Marbella, the French Riviera, Cyprus, Bulgaria or even Latvia has traditionally been quite sizeable. According to some estimates, Russians invested more than £1.5 billion (around $2 billion) in London real estate alone.[20] With growing pressure on Russian citizens (UK banks imposed a £50,000 limit ($66,860) on Russian nationals' deposits,[21] while EU banks do not accept deposits above €100,000, or around $110,000), they may try to sell their properties and leave, which may push the prices lower and decrease the overall value of European real estate. What might also be expected is a massive relocation of Russian money from Europe to safer destinations like the United Arab Emirates, Turkey, and even Hong Kong. Swiss, Luxemburg, and British banks will record huge outflows of Russian money.

Russian Tourists In Europe

Fifth, it seems Europe will lose huge crowds of Russian tourists, which have been looking forward to returning to European countries after the pandemic regulations had eased by early 2022. In 2019, more than 12 million tourist arrivals from Russia were recorded in Europe. On average, in 2018, it was calculated that Russian tourists spend $1,676 per trip.[22] Furthermore, according to the Italian national agency for tourism, ENIT, the total expenditure of Russian tourism in Italy in 2019 amounted to 984 million euros.[23]

This year such an inflow will dry up almost completely as most of Russian citizens, leaving the country due to their disillusionment with Putin's regime, will settle outside the EU (mostly in Georgia, Montenegro, UAE, and Turkey). The losses occurring from discontinuing in servicing numerous Russian destinations by European air companies as well as from banning the Russian aircraft in EU airspace, should also be considered.

Furthermore, as a consequence of the fact that the EU decided to terminate the aircraft sales and leasing to the Russian entities, the Russian Federation refused to return more than 500 aircraft worth $20 billion to Western lessors.[24] This episode is a quite a bad sign that may signal Russia's readiness to proceed with one or other ways of nationalizing the property held by foreign – and predominantly European – owners.

Conclusion

The overall impact that the Russian aggression against Ukraine may have on the European economy appears to be quite significant, claiming up to €400 billion (around $442 billion), or roughly 2.7 percent of EU combined GDP, in its first year.

Nevertheless, the damage looks not too huge compared to the recent Covid-19 pandemic that cost the European not less than €2 trillion (around $2.21 trillion). The extraordinary character of the event, being the first full-scale interstate war waged on the European soil since the defeat of Nazi Germany in 1945, should be considered. The EU possesses all the means for offsetting the consequences of this confrontation, since its member countries can increase the sovereign borrowing at ultra-low rates, while the funds raised will be devalued by inflation in the coming years. At the same time, through these losses, the Europeans are making an important investment into their continent's future, since Russia may be expected to remain an important threat to the West in the upcoming years and therefore any reinforcement of Ukraine and securing the "Eastern wall" will pay off.

Russian policymakers try to claim that Europe pays more to the sanctions it imposes on Russia than Russia itself loses. This is simply not true. This time, Russia has taken a major blow with its stock market being ruined, hundreds of thousand jobs lost, the national currency devalued, and the trade connections disrupted. Of course, the entire effect of the Western sanctions may not be seen immediately, but there is no doubt that they are hurting and eroding the Russian economy.

I would argue that these sanctions represent the sacrifice of the Western businesses and governments, since they are unable to change Russia's political course that depends just upon Putin's wishes. However, to impose these sanctions was the only option short of declaring war on Russia that has been at the West's disposal for reacting on all the unbelievable atrocities the Russian forces produce in Ukraine. Hence, I would say that this is not the time for Europeans to calculate their losses. As an old adage goes, "делай что должно, и будь что будет [do what you must and come what may]."

* Dr. Vladislav L. Inozemtsev is a special advisor to the MEMRI Russian Media Studies Project.

[1] Npr.org/2022/03/09/1085509937/house-advances-13-6-billion-in-ukraine-aid-along-with-government-funding, March 9, 2022.

[2] Bbc.com/news/world-60555472,

[3] Notesfrompoland.com/2022/03/14/poland-passes-law-expanding-support-for-ukrainian-refugees/, March 14, 2022.

[4] Ec.europa.eu/regional_policy/en/newsroom/news/2022/03/23-03-2022-ukraine-eur3-4-billion-react-eu-pre-financing-to-member-states-welcoming-refugees-fleeing-ukraine, March 23, 2022.

[5] Cbr.ru/vfs/statistics/credit_statistics/direct_investment/dir-inv_in_country_1.xlsx

[6] Autostat.ru/news/50798/

[7] Best-selling-cars.com/brands/2021-full-year-global-volkswagen-brand-worldwide-car-sales-by-model-and-country/, January 12, 2022.

[8] Groupe-elo.com/app/uploads/2022/02/2021_12_ELO_communiqu%E2%80%9A-VDEF_UK-1.pdf, 2021; Finmarket.ru/news/5660894, February 25, 2022.

[9] Country.db.com/russia/documents/Deutsche_Bank_IFRS_2020_final.pdf

[10] Cnbc.com/2022/03/14/deutsche-bank-to-wind-down-russia-operations-in-major-u-turn.html, March 14, 2022.

[11] Quote.rbc.ru/news/article/6221ee339a7947134503de67, March 18, 2022.

[12] Neweurope.eu/article/pressed-by-sanctions-russia-narrowly-escapes-default/, March 17, 2022; Finmarket.ru/shares/news/5621401, December 30, 2021; Finmarket.ru/shares/news/5684596#:~:text=%D0%B3%D0%BE%D0%B4%D0%B0%2019%3A45-,%D0%9A%D0%B0%D0%BF%D0%B8%D1%82%D0%B0%D0%BB%D0%B8%D0%B7%D0%B0%D1%86%D0%B8%D1%8F%20%D1%80%D0%BE%D1%81%D1%81%D0%B8%D0%B9%D1%81%D0%BA%D0%BE%D0%B3%D0%BE%20%D1%80%D1%8B%D0%BD%D0%BA%D0%B0%20%D0%B0%D0%BA%D1%86%D0%B8%D0%B9%20%D0%9C%D0%BE%D1%81%D0%BA%D0%BE%D0%B2%D1%81%D0%BA%D0%BE%D0%B9%20%D0%B1%D0%B8%D1%80%D0%B6%D0%B8%20%D0%B2%20%D1%81%D0%B5%D0%BA%D1%82%D0%BE%D1%80%D0%B5%20%D0%9E%D1%81%D0%BD%D0%BE%D0%B2%D0%BD%D0%BE%D0%B9%20%D1%80%D1%8B%D0%BD%D0%BE%D0%BA,%D1%81%D0%BE%D1%81%D1%82%D0%B0%D0%B2%D0%B8%D0%BB%D0%B0%2046202%2C352%20%D0%BC%D0%BB%D1%80%D0%B4%20%D1%80%D1%83%D0%B1, March 24, 2022.

[13] Globalpetrolprices.com/gasoline_prices/Europe/, March 28, 2022.

[14] Reuters.com/business/energy/europes-efforts-shield-households-soaring-energy-costs-2022-02-03/, February 3, 2022; Eulerhermes.com/en_global/news-insights/economic-insights/energy-prices-household-income-squeeze.html, March 4, 2022.

[15] Consilium.europa.eu/en/press/press-releases/2022/03/24/g7-leaders-statement-brussels-24-march-2022/, March 24, 2022.

[16]Tadviser.ru/index.php/%D0%A1%D1%82%D0%B0%D1%82%D1%8C%D1%8F:%D0%AD%D0%BA%D1%81%D0%BF%D0%BE%D1%80%D1%82_%D0%BD%D0%B5%D1%84%D1%82%D0%B8_%D0%B8%D0%B7_%D0%A0%D0%BE%D1%81%D1%81%D0%B8%D0%B8,

[17] Imrussia.org/en/opinions/3172-why-the-cancellation-of-nord-stream-2-will-punish-russian-citizens,-not-the-kremlin, September 24, 2020.

[18] Washingtonpost.com/business/2022/03/08/russia-oil-imports-ban/, March 8, 2022; Washingtonpost.com/business/2022/03/08/russia-oil-imports-ban/, March 8, 2022.

[19] Iea.org/reports/russian-supplies-to-global-energy-markets/oil-market-and-russian-supply-2

[20] Businessinsider.com/real-estate-investing-analysis-russia-ukraine-putin-oligarchs-london-properties-2022-3, March 2022.

[21] Finance.yahoo.com/news/britain-imposes-50-000-pound-180948908.html, February 24, 2022.

[22] Atorus.ru/news/press-centre/new/50475.html, February 17, 2020.

[23] Roma.repubblica.it/cronaca/2022/03/03/news/guerra_russia_ucraina_roma_mercato_lusso_crollo-340021419/, March 3, 2022.

[24] Epravda.com.ua/rus/news/2022/03/23/684582/, March 23, 2022.