Graphics source: The Express Tribune, April 22, 2013

Pakistan is promoting Islamic banking; as per some media reports, the move seems to be part of a comprehensive program to promote the Islamization of the country's banking sector. Over the past few decades, there has been growing recognition in Pakistan that the country could lead the Muslim world in Islamic banking. According to a Pakistani media report, "Islamic banking in Pakistan has recorded a reasonable growth and its asset base has grown to 1 trillion Pakistani rupees. However, consumers are still skeptical as to whether the products of Islamic banks are Riba[usury/interest]-based like that of conventional banks or are Riba-free."[1]

In January 2014, the Pakistani government, in a bid to promote the Islamization of Pakistan's banking sector, appointed renowned Islamic scholar and former judge Taqi Usmani as chairman of the Sharia Board of the State Bank of Pakistan (SBP). In an interview, Usmani confirmed that he "accepted the responsibility following the government's assurance to promote the Islamic banking system so that the conventional riba-based system is replaced."[2] The government also appointed Saeed Khan, chairman of a recently constituted committee on Islamic banking, to the post of the deputy governor of the SBP in order – according to a Pakistani media report – "to ensure that the conventional banking system is replaced by the Islamic banking system as per the teachings of Islam and in line with the provisions of the 1973 Constitution."[3]

According to the report, SBP Governor Yaseen Anwar noted in a recent speech that "Pakistan, with more than a 95 percent Muslim population, and a constitutional obligation of ensuring a riba-free economic system, has had a favorable response to Islamic finance."[4] Anwar stated: "Pakistan is amongst the pioneers of Islamic finance, as we started planning for nurturing the sharia-compliant financial system way back in the 1970s, and made a bold attempt in the 1980s to bring the whole banking and financial system in conformity with sharia principles... [T]he pioneering work of the 1980s, particularly on the legal and regulatory front, has been a source of guidance and inspiration for many countries that initiated Islamic finance in the 1980s and '90s."[5]

On December 26, 2013, Dr. Iqrar Ahmad Khan, Vice Chancellor of the University of Agriculture Faisalabad (UAF), noted that Islamic banking is gaining popularity as its volume has touched $1.4 trillion globally and added: "Islam is a religion of peace and provides solutions to all problems facing the globe."[6] He was speaking at an event, a symposium on Islamic banking in emerging economies, which was organized by the Institute of Business Management Sciences, the UAF, the Meezan Bank of Pakistan and the Dubai Islamic Bank.

The key argument of Islamic scholars is that Islamic banking is free of interest/usury, with ordinary people finding it difficult to distinguish between "usury" and "interest" offered by conventional banks and sharia-compliant financial instruments. Nevertheless, several Muslim nations are making a serious effort in promoting a sharia-compliant banking sector, since it delivers a political and diplomatic dividend as an indirect consequence of such international collaborations. Some like Turkey and Pakistan are emerging as leaders in the Muslim world through such efforts, as examined in the Pakistani media reports and articles, excerpts from which are given below.

Report: "In The Year Preceding June 30, 2012, Islamic Banking Deposits Grew 33.4%, To 603 Billion Pakistani Rupees – At A Time During Which The Banking Sector As A Whole Grew By A Much Lower 14.4%"

On April 22, 2013, a Pakistani newspaper published a report by journalist Farooq Tirmizi, examining the growth of Islamic banking in Pakistan. Following are excerpts from the report:

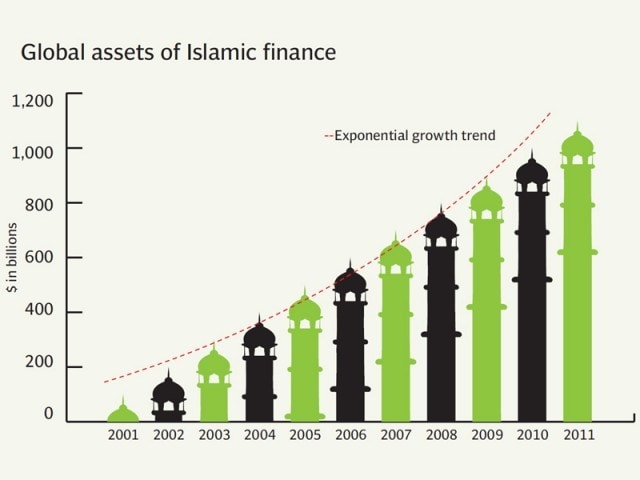

"Islamic banking is the fastest growing segment of Pakistan's financial services sector, a fact that has caused many institutions to pile onto the sharia-compliant bandwagon. Yet what is it that makes the Islamic banking customer tick? Why is there such a stampede of depositors at their doorstep? And can they continue growing at this rapid clip. In our special report this week, The Express Tribune takes a look at what is making the Islamic financial services industry grow quite so fast. First, some of the statistics: According to data from the State Bank of Pakistan, between 2002 and 2011, deposits at Islamic banks grew at an average annual rate of 59.6%, compared to the banking sector average of 16.1% per year during that same period.

"And lest anyone think this is simply the low-base effect, in the year preceding June 30, 2012, Islamic banking deposits grew 33.4%, to 603 billion Pakistani rupees – at a time during which the banking sector as a whole grew by a much lower 14.4%. Islamic banking now accounts for 9.4% of all deposits in Pakistan, up from virtually nothing a decade ago. There appears to be no single comprehensive study that explains the rise in deposits at these institutions. Most of the academic studies... reveal that substantial majorities of Islamic banking customers prefer the system largely owing to its perceived compliance with sharia.

"But according to a study conducted in 2008 by Naveed Azeem Khattak and Kashifur Rehman, professors at Shaeed Zulfikar Ali Bhutto Institute of Science and Technology (Szabist) and Iqra University respectively, a staggering 67% of Islamic banking customers also use conventional banks, largely due to what they perceive to be a wider range of services offered by conventional banks. Religion is important to the Pakistani banking customer, but they do not seem to be agnostic to service quality either. This phenomenon appears to have resulted in shift in attitudes about the marketing of Islamic financial services in Pakistan. The Emirates Global Islamic Bank advertising campaign in 2009 – which implied that conventional banking customers would go to hell – was a disaster and the bank ended up being absorbed by Al Baraka Bank.

"And the more recent advertising campaigns of Meezan Bank and Burj Bank appear to emphasize tradition and values rooted in Islam, but are not judgmental of those who choose not to use the Islamic banking system. Ultimately, however, the Islamic banks seem to have caught on that simply having a bearded [scholars'] board of sharia advisers is not enough. They need to compete on their service breadth and quality. The Islamic bank CEOs who have spoken to The Express Tribune over the past three years have all emphasized the fact that their banks now offer the full complement of services offered at conventional banks. Some go even further. Meezan Bank, for instance, is the only bank in the country that offers a laptop financing scheme as a separate product.

"As for whether or not the industry can continue to grow at these breakneck speeds, there appears to be a consensus that the massive growth spurt in Islamic banking still has some years left in it. This phenomenon is particularly helped by the fact the two largest banks in this category – Meezan Bank and BankIslami – have continued to add branches to their nationwide network, offering more customers the opportunity to switch their financial services to Shariah-compliant modes...."[7]

Article: "Businessmen, Represented And Aided Mostly By Graduates Of Traditional Islamic Schools..., Have Quietly Been Raising A Lot Of Investment From People"; "They Claim To Do Business In Strict Conformity With Sharia And Offer Unbelievably High Returns"

In April 2013, an article titled "Is Islamic banking as exploitative as conventional banking?" and published by The Express Tribune daily noted:

"[M]any groups of businessmen, represented and aided mostly by graduates of traditional Islamic schools or madrassas, have quietly been raising a lot of investment from people around the country, especially from the Islamabad and Rawalpindi region, and the areas in the north as far as Gilgit-Baltistan. They claim to do business in strict conformity with sharia and offer unbelievably high returns to their investors, which to date has been over 50% per annum or around 5% per month. There are a lot of small groups, mostly led by religious scholars from one prominent school of thought. The most notable of these is the Elixir Group.

SUPPORT OUR WORK

"The Group's website offers general information on its business activities and investments, which are reported to be in Pakistan, Malaysia, Thailand, the United Arab Emirates, Sri Lanka, Ethiopia and even in China. While the website does not offer information on the directors and shareholders of the Group, some officials at their Rawalpindi office... disclose that a Lalika family is behind the Group. They claim to own big names like Rocco Ice Cream and Prime Dairies, and are planning to start a housing scheme in the name of Sukoon Housing. Since the Group is neither a regulated entity nor is well-known outside some very specific circles, many people who have come across it are at best confused. On one hand, they are tempted by the very high returns offered to investors; on the other hand, they are nervous and confused, owing to the mystery surrounding the different businesses in which the Group claims to have invested.

"Apart from some general information on its website, the Group does not provide any financial information on its activities, as most of the investments received by the Group from the general public are in cash. As the Group claims to have invested in a number of overseas projects, questions arise on the channels it has used for transfer of money from Pakistan. There are many questions related to conducting due diligence, a regulatory requirement for banks and other investment companies when accepting investments from the general public.

"There is a definite need to look into the matter with respect to money laundering, even if the investments are genuine, and the returns offered by the Group actually come from the investments made by it in different projects. There are also questions related to corporate governance, as there is no information at all on the so-called founding shareholders and directors of the company...."[8]

Article "Rising Partner: A Turkey-Pakistan Alliance For Islamic Banking" Says: "Pakistan Presents The Most Sharia Authentic Model Of Islamic Banking...; Being A Predominantly Hanafi... Country, Turkey Can Also Achieve The Kind Of Sharia Authenticity That Malaysia Has Yet To Develop"

An October 15, 2012 article titled "Rising partner: A Turkey-Pakistan alliance for Islamic banking" in a Pakistani newspaper examined the emergence of Turkey as an alliance partner with Pakistan in the sphere of Islamic banking.

"Turkey is on track to becoming the next hub for Islamic banking and finance. Given the Ottoman legacy, the last seat of the Islamic viceregency, the government of Turkey was only required to show its commitment to Islamic finance before other players in the industry were going to join her in building a vibrant Islamic banking and finance industry. The recent successful dollar-denominated $1.5 billion sovereign Sukuk issue, followed by a lira-denominated $900 million sovereign Sukuk have put the country on the global platform of Islamic banking and finance. It is expected that many Middle Eastern Islamic banks and financial institutions will enter the Turkish market in the future.

"Kuwait Finance House (KFH) entered Turkey in 1989 well before an explicit commitment came from the then government that had been rather hostile towards any non-secular developments. It preceded KFH's move into other markets like Malaysia, Bahrain and Jordan over several years. Despite personal encouragement by then governor of State Bank of Pakistan (SBP), Dr. Ishrat Husain, KFH did not enter the Pakistan market and remains reluctant. On the other hand, Albaraka Bank set up a participation bank (a Turkish term used to describe Islamic banks) in 1984, well before it entered the Pakistani market in 1991.

"It will not be surprising if Turkey starts posing competitive threats to Pakistan, in terms of becoming a destination of preference for many Middle Eastern investors who currently invest in Pakistan and Malaysia, as for many institutions in the Middle East it makes more logistic sense to do business in Turkey rather than travelling to the Far East.

"Pakistan presents the most sharia authentic model of Islamic banking in the world. Being a predominantly Hanafi – a stricter school of Islamic jurisprudence in matters related to business and finance – country, Turkey can also achieve the kind of sharia authenticity that Malaysia has yet to develop, if she attempts to learn from the sharia governance regime developed by the SBP. Hence, a Turkey-Pakistan alliance will not only help to promote Islamic banking in Turkey, but is also expected to bring a new juristic approach to product development and structuring.

"It is important for Pakistan to show more commitment to Islamic banking and finance and use it as a strategic tool to seek help from Turkey in order to raise funding for a number of infrastructural projects that need external financing. Through adopting a leadership role in Islamic banking and finance, Pakistan can regain its lost standing in the Organization of Islamic Cooperation (OIC) block. A number of OIC-level projects came to Pakistan, e.g. International Islamic Chamber of Commerce and Industry, which either failed or moved to other countries because of lack of support and commitment from the government.

"It is now a good opportunity for Pakistan to strike a deal with Turkey to share her expertise in the field of Islamic banking and finance. While the likes of Malaysia have invested millions of dollars to set up institutions like INCEIF to develop required human resources for Islamic banking, Pakistan can develop a state-of-the-art centre of excellence for Islamic finance by investing a small amount in [Islamic seminary of] Darul Uloom Karachi, developing it into a teaching and research university specializing in Islamic banking and finance.... The Darul Uloom model of education is certainly more cost effective as compared with INCEIF, which has a huge annual budget...."

Article In Pakistani Daily Examines Myths Of Islamic Banking, States: "The Muslim World Continues To Suffer From A Collective Self-Conceit That The Banking System Has Been Baptized The Islamic Way"

On September, 27 2009, liberal Pakistani website Dawn.com published an article, by a Pakistani economist whose name seems to have been inadvertently deleted, examining a series of myths about with Islamic banking. Following are excerpts from the article:

"It is interesting to note that it is not only the Islamic Development Bank at Jeddah but the IMF [International Monetary Fund] and the World Bank as well which are promoting the cause of Islamic banking. The IMF at one stage had opened a sharia department with the sole responsibility of devising sharia-compliant securities for domestic and external debt and transforming the existing financial system in the Islamic world on lines specified by the sharia department. What has been the success of these ventures is now of historical interest only. However, IMF staff did contribute their share to the stream of literature on the subject....

"The first or the primary myth which has gained common currency throughout the Islamic world is based on gross misinterpretation of the Koranic verses on Riba, which have led to the conclusion that Riba prohibited in the Koran and the bank interest are identical and as such interest must be abolished from all tiers of the economy including banking. The Muslim scholars have never seriously and dispassionately discussed the three basic and inter-related questions. What is Riba? What is interest? Are Riba and interest co-equal or synonymous? As a result of the failure of Islamic scholars to critically address these fundamental questions, the myths on Islamic banking continue to flourish.

"The second myth around which the concepts of Islamic banking and Islamic economy are developed, points out that interest is the basic cause of the ills from which modern economies suffer such as unemployment, inflation, depression, income inequalities, poverty, etc. Remove the norm of interest and the economic system would be fully purified (Islamized) with no unemployment, no inflation and no income and wealth inequalities.

"The third myth is in the form of the popular claim that there are as many as 200 banking units or banking companies which operate around the globe without interest and that these banks represent alternative models to interest-based banking. Even the western secular banking companies are now opening branches of Islamic banks or Islamic windows as these companies are convinced of the superiority of Islamic banking over the interest-based banking. The fourth myth is that the mode of profit-loss-sharing (PLS) is truly an Islamic mechanism and as such it can best serve as the basis of Islamic banking. In other words, PLS can replace the norm of interest in the banking industry and can give optimal results.

"The fifth myth is that J.M. Keynes as one of the greatest economists of the twentieth century, in his numerous writings, has propounded and approved the structure of an economy which is free from interest. The Koranic injunctions and interpretations forbidding interest are thus supported by the worldly economists such as J.M. Keynes. The sixth myth stipulates that Islamic banking will become a reality once the Islamic economic system is established in its totality. In other words, the successful launching of true Islamic banking is contingent upon realizing the objective of transforming the existing economic systems which are secular in their outlook and spirit on Islamic lines. If a truly Islamic economic system is established in a particular country or globally, operating Islamic banking and financial system will be feasible and practicable.

"The mythology of Islamic banking is being propagated as a new gospel throughout the Islamic world. Scholars in Pakistan, Indonesia, Malaysia, Bangladesh, Sudan, Iran, Egypt and Saudi Arabia, etc. have invested immense mental energies on themes of Islamic banking, Islamic economics, etc. Their innovative research, bizarre interpretations and newly defined models have only led them to camouflage the norm of interest under esoteric nomenclature such as mark-up, rates of return, profit ratio etc. Interest remains the foundation of all Islamic banking institutions. At the same time the Muslim world continues to suffer from a collective self-conceit that the banking system has been baptized the Islamic way. However, in a real world scenario, if interest is abolished through an ordinance or an administrative fiat, the Muslim world would face an unparalleled predicament of economic disorder and disaster."[9]

Endnotes:

[1] The Express Tribune (Pakistan), December 11, 2013.

[2] The News (Pakistan), January 19, 2014.

[3] The News (Pakistan), January 19, 2014.

[4] The News (Pakistan), January 19, 2014.

[5] The News (Pakistan), January 19, 2014.

[6] The Express Tribune (Pakistan), December 27, 2013.

[7] The Express Tribune (Pakistan), April 22, 2013.

[8] The Express Tribune (Pakistan), April 22, 2013.

[9] Dawn.com (Pakistan), September 27, 2009.